FanDuel, DraftKings Dominate Illinois Sports Betting Market Share

Jump to main content

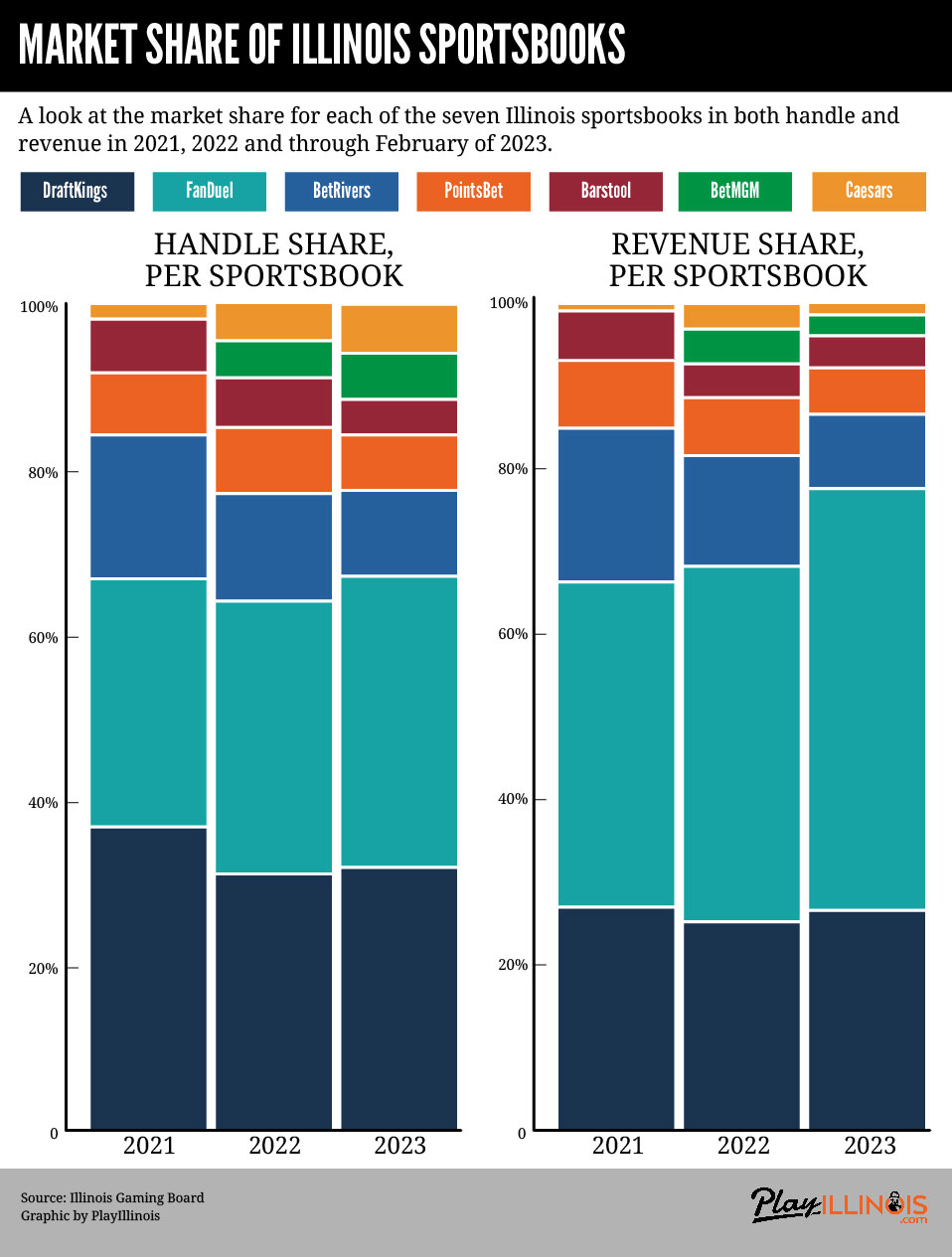

Which sportsbook is regarded as the top choice in Illinois? The answer may differ depending on how you assess them. Nevertheless, it is clear that DraftKings and FanDuel are the leading contenders in the Illinois market.

Play Illinois found that DK and FD collectively dominate more than 60% of the market after analyzing the statistics from the Illinois Gaming Board.

This indicates that the remaining 40% is being disputed by the five other IL sports betting sites.

Illinois’ seven legal sportsbook operators have collectively handled over $20.4 billion in bets since their inception. According to the latest data from the IGB, the state surpassed the $20 billion handle milestone in February. Illinois is recognized as a top jurisdiction for sports betting in North America, consistently ranking among the top three.

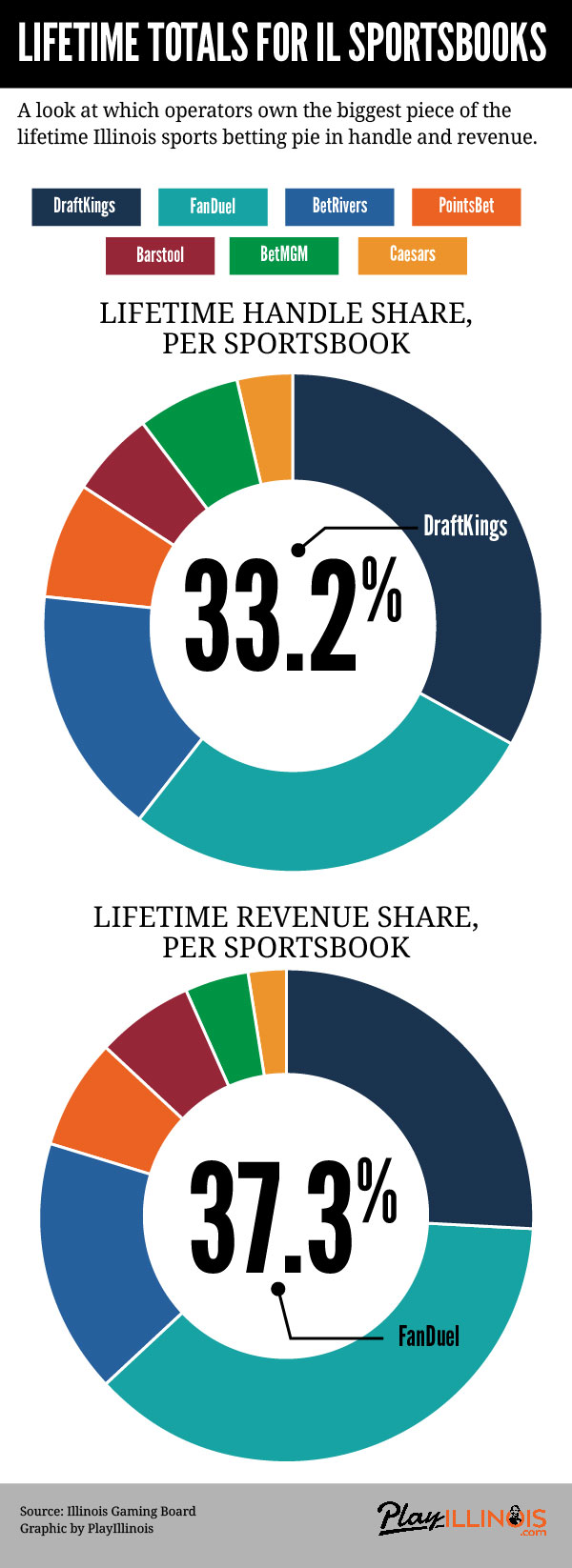

DraftKings is the top Illinois sports betting site, with over $6.8 billion in wagers and a market share of 33.2%. FanDuel follows closely behind with a market share of 27.3% and nearly $5.6 billion in wagers.

The total revenue generated by the seven sportsbooks in Illinois up to February 2023 has surpassed $1.6 billion. FanDuel is the top earner, bringing in over $600 million in lifetime revenue, making up 37.3% of the market share. DraftKings follows closely behind with a revenue of nearly $420 million and a market share of 26%.

A complete look at the market share

As of February 2023, the rankings for lifetime market share by handle are as listed below:

- DraftKings leads with 33.2% market share, followed by FanDuel at 27.3% and BetRivers at 16.1%. PointsBet and BetMGM follow with 7.7% and 6.6% respectively. Barstool and Caesars hold 5.5% and 3.5% of the market share.

FanDuel has surpassed the competition to claim the number one spot in revenue, flipping the previous number one and two positions.

Revenue-based market share for the entire duration until February 2023:

- FanDuel holds the largest market share at 37.3%, with DraftKings following closely behind at 26%. BetRivers holds 16.6% of the market, while PointsBet and BetMGM have 7.3% and 6.3% respectively. Barstool has a 4.3% share, and Caesars has the smallest market share at 2.3%.

Where that leaves the other five Illinois sportsbook operators

Therefore, it is evident that DraftKings and FanDuel dominate a significant share of the sportsbook market in Illinois. How will this impact the remaining five sports betting sites in the state?

Based in Illinois, BetRivers holds a solid third place in its home state, overseeing over $3.3 billion in bets and earning nearly $268 million in revenue. This means that the company is responsible for just over 16% of the total sports betting turnover and around 16.6% of the overall revenue.

FanDuel, DraftKings, and BetRivers collectively make up more than 75% of the regulated sports betting market in Illinois.

PointsBet, BetMGM, Barstool, and Caesars are not in a favorable position.

Bottom four Illinois sports betting operators divide up remaining 25%

PointsBet is the fourth largest sportsbook in Illinois, representing approximately 7.7% ($1.5 billion) of the total market share. With a lifetime revenue of over $117 million in the state, PointsBet contributes around 7.3% to Illinois’ total sports betting revenue, which exceeds $1.6 billion.

BetMGM, Barstool, and Caesars collectively control approximately 13% to 16% of the Illinois market.

The remaining three are ranked in terms of handle and revenue as follows:

- Barstool BetMGM Caesars

In terms of revenue, BetMGM Illinois is at the top with over $101 million, followed by Barstool with nearly $70 million. Caesars is in seventh place in the state with just under $40 million. This means that BetMGM Illinois has a revenue share of 6.3%, Barstool has 4.3%, and Caesars has 2.3%.

Total revenue earned up to February 2023:

- FanDuel leads with $601,754,326, followed by DraftKings with $419,159,877, BetRivers with $267,827,419, PointsBet with $117,232,821, BetMGM with $101,205,956, Barstool with $69,987,485, and Caesars with $36,926,648.

When looking at handle numbers, the gap between BetMGM and Barstool narrows slightly. BetMGM has a lifetime handle of over $1.3 billion in Illinois, while Barstool has received more than $1.1 billion in bets in the same state. Caesars, on the other hand, has handled over $721 million. This translates to handle shares of 6.6%, 5.5%, and 3.5% for each, respectively.

Handle valid indefinitely (until February 2023).

- DraftKings — $6,800,930,712

- FanDuel — $5,583,131,054

- BetRivers — $3,303,421,020

- PointsBet — $1,565,765,310

- BetMGM — $1,360,091,685

- Barstool — $1,130,026,574

- Caesars — $721,219,850

Market dominance makes it tough for new sportsbooks in Illinois

Sometime this year, Circa is expected to become the eighth legal sports betting operator in Illinois.

Circa faces a daunting task as the top three operators dominate more than three-quarters of the market. Despite this, Circa sets itself apart by catering to high-stakes bettors and offering a sportsbook with no restrictions, distinguishing itself from its competitors.

In November, Play Illinois evaluated the sportsbooks anticipated to launch in the state next.

There are at least 14 open slots available for an online sportsbook to enter the Illinois market, with the possibility of more openings.

- Six connected to a licensed retail casino.

- Five new casino applicants are tethered together.

- Three sportsbook licenses are available exclusively online.

- It is possible that up to four are connected to professional sports venues.

The cost of entry is a valid concern, but there are current discussions in Springfield about potential legislation aimed at lowering the expenses.

Currently, the minimum cost for a sportsbook license is $5 million. Entry into the market for original retail casino license holders was priced at 5% of adjusted gross receipts or a percentage of handle for the two horse racing tracks. The cost varied between approximately $2.3 million and $10 million.

The base cost for any new casino or track is determined by a percentage, with a minimum price of $5 million. Running a sportsbook at a professional sports facility requires a fee of $10 million.

You can purchase three online-only sportsbook licenses for $20 million each, without the requirement of being tied to a retail casino.