Illinois Collected A Record $1.9 Billion In Gambling Revenue In 2022

Go directly to the content

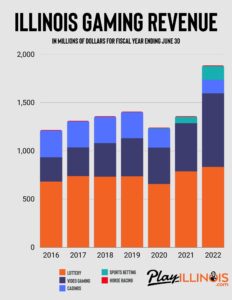

Illinois achieved a new milestone in gambling revenue for the fiscal year 2022, ending on June 30. The state’s gaming income of approximately $1.9 billion surpassed the previous record of around $1.4 billion set in 2019.

The information comes from the 102-page report titled ‘Wagering in Illinois 2022’, produced by the Commission on Government Forecasting and Accountability in the state.

The report shows a significant 38.8% rise in revenue from taxes and licensing fees in 2022 compared to 2021, attributed mainly to two key factors.

- Recovering gaming revenues following the challenging years of the COVID-19 pandemic.

- The gambling industry in Illinois saw a major boost in June 2019 with the passing of legislation that allowed for the legalization of sports betting. This also paved the way for the establishment of six new land-based casinos across the state, with a prominent location in Chicago. Additionally, the law allowed for an increase in the number of video gaming terminals available.

The report said:

In Illinois, tax revenues from gaming decreased by 11.7% to $1.240 billion in the 2020 fiscal year, as designated by the state. However, they rebounded with a 9.5% increase to $1.358 billion in the 2021 fiscal year. Despite this improvement, these revenues still fell short of the $1.404 billion generated in the pre-pandemic 2019 fiscal year.

Illinois set new revenue records in the fiscal year 2022 for:

- Lottery: $833 million

- Video gaming: $762 million

- Sports betting: $142 million

Illinois sports betting a new revenue source for the state

According to the report, Illinois sportsbooks brought in around $611 million in adjusted gross receipts during the second full year of legalized sports betting in the state. Licensing fees also contributed to the additional revenue.

In Illinois, sports betting has created a new source of revenue for the state. In fiscal year 2021, tax revenues of $57 million were generated from a total adjusted gross receipts of $380 million. By fiscal year 2022, the tax total from sports betting had increased to approximately $92 million, thanks to a 15% tax on an adjusted gross receipts total of slightly over $610 million. Additional income is collected through licensing fees. The majority of this tax revenue and fees are designated for the Capital Projects Fund and the Rebuild Illinois Projects Fund.

Statistics on Illinois sports wagering

The figures are measured in millions of dollars and are organized by fiscal year.

| Fiscal Year | Wagers | Handle | Payout | Adjusted Gross Revenue | Tax Revenue |

|---|---|---|---|---|---|

| 2020 | 192,007 | $9 | $8 | $0 | $0 |

| 2021 | 146,8883,248 | $5,106 | $4,727 | $380 | $57 |

| 2022 | 221,742,054 | $8,515 | $7,904 | $610 | $92 |

| TOTAL | 368,817,309 | $13,630 | $12,639 | $991 | $149 |

The growth of IL sports betting was greatly enhanced by the decision to eliminate in-person sportsbook registration.

This has allowed a new wave of gamblers to enter the world of sports betting, especially as mobile users using sportsbook apps.

Not including the 15% rate, the state’s revenue from sports betting licensing fees was:

- $7.1 million in 2020

- In 2021, the expansion of sports betting throughout the State resulted in a total of $61.8 million in revenue.

- $14.3 million in 2022.

The expected drop in numbers from 2021 to 2022 came after the initial increase in new licenses in 2021.

However, by increasing the number of licenses allocated and implementing a 4-year renewal fee, we expect to generate a steady stream of income from fees in the years to come.

Overall, the state has collected more than $83 million in licensing fees from sports betting.

Record revenue despite lower average tax rates

The report attributes the record-breaking revenue to the strong growth of the lottery, video gaming, and sports betting sectors, despite lower tax rates and a decline in casino revenue.

In fiscal year 2022, lottery transfers were the biggest source of gaming tax revenues, making up 44.2% of the total revenue. However, this percentage has been steadily decreasing since reaching a peak of 67.8% in fiscal year 2013. On the other hand, video gaming revenue has seen a significant increase over the past decade, now accounting for 40.4% of total revenue. Casino transfers, which used to be responsible for over 50% of gaming-related revenues, have dropped to 7.4% in fiscal year 2022. Sports wagering, in its second full year, has quickly grown to contribute 7.5% of total revenue. Horse racing revenues continue to play a minimal role, contributing only 0.4% of total revenue.

The increase in video gaming revenue is a result of the growing number of machines in Illinois. In 2019, the state approved an expansion of terminal limits, allowing regular establishments to have up to 6 machines and eligible truck stops to have up to 10 terminals. With over 43,000 machines now in operation, Illinois has seen a substantial 36.1% increase in net terminal income from 2021 to 2022.

Nevertheless, this has led to a 20.3% drop in casino revenue compared to the previous year.

However, when video gaming totals are added to revenues, there has been a 140.2% increase from $1.6 billion to $3.9 billion.

What are the tax rates?

The average effective tax rate on all gaming decreased from 27.3% in 2020 to 20.1% in 2022.

The Education Assistance Fund experienced a drop in revenue transfers, with only $140 million transferred in FY 2022 compared to previous years. Although there is expected growth in Adjusted Gross Revenue (AGR) in the future because of new casino developments, the overall increase in tax revenue from this gaming expansion is projected to be minimal. This is because existing gaming options are being negatively affected by the new developments and the altered tax structure is impacting revenues.

Sportsbooks in Illinois are subject to a 15% tax rate.

The tax rates for casinos are determined by a graduated scale, depending on whether the gambling took place at a table game or an electronic gaming device. It is important to be aware that the Chicago casino will have its own unique percentages. The tax rates are outlined below:

| Adjusted Gross Receipts | Previous Rate | New Rate on Table Games | New Rate on Electronic Gaming Devices |

|---|---|---|---|

| Up to $25 million | 15% | 15% | 15% |

| $25M to $50M | 22.5% | 20% | 22.5% |

| $50M to $75M | 27.5% | 20% | 27.5% |

| $75M to $100M | 32.5% | 20% | 32.5% |

| $100M to $150M | 37.5% | 20% | 37.5% |

| $150M to $200M | 45% | 20% | 45% |

| Over $200M | 50% | 20% | 50% |

The tax rate on video gaming has risen to 34% of the net terminal income, up from 30% before 2019 and 33% from 2019 to 2021 when the current rate was introduced.

The State’s increased contribution to the Capital Projects Fund can be attributed to higher tax rates and a significant boost in net terminal income.

The Illinois lottery saw a small decline in total sales in 2022, falling to $3.396 billion, a 1.6% decrease from the previous year. Preliminary and unaudited data from the Lottery indicated that operating costs, such as prizes, commissions, bonuses, and administrative expenses, totaled $2.563 billion.

The lottery alone brought in $833 million in revenue for the state.

Illinois ranks 12th in the US in lottery

At the close of Illinois’ fiscal year, complete national statistics were not yet released. However, based on data from the North American Association of State and Provincial Lotteries, Illinois ranked 12th in the U.S. for traditional lottery sales in both FY 2021 and 2020. Traditional sales encompass instant and draw games, excluding electronic gaming machines and table games.

The states that led the nation in lottery sales in 2021 were:

- Florida has $9.1 billion, California has $8.4 billion, Texas has $8.1 billion, and New York has $7.7 billion in revenue.

Illinois ranked 21st in per capita lottery sales in 2021, with $272 per person, showing a 21% rise from the previous year. The states with the highest per capita sales were:

- Massachusetts costs $833 per person.

- Georgia — $544

- Michigan — $502

Illinois residents spent 0.41% of their personal income on lottery tickets in 2021, up from 0.35% in 2020. In both years, Illinois ranked 24th in this category.

Where the tax revenue goes

Here is a brief summary of where all this money is allocated:

- The Lottery contributes to various funds, including the Common School Fund and Capital Projects Fund, after deducting costs for prizes, agent commissions, and administration. Since its inception in 1975, the Lottery has generated nearly $80 billion in sales and distributed over $24 billion back to the State.

- Gambling on athletics: The Capital Projects Fund and the Rebuild Illinois Projects Fund.

- 85% of the revenue generated from video gaming is directed towards the Capital Projects Fund, with the remaining 15% going to local governments.

- Casinos: Education Assistance Fund.