Illinois Collected A Record $1.9 Billion In Gambling Revenue In 2022

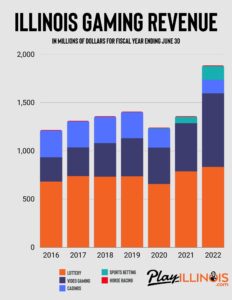

The state of Illinois set a new record for total gambling revenue in the fiscal year 2022, which concluded on June 30. The Illinois gaming income of approximately $1.9 billion comfortably eclipsed the prior record of around $1.4 billion established in the Prairie State in 2019.

The data is sourced from the 102-page ‘Wagering in Illinois 2022’ report, which was created by the Commission on Government Forecasting and Accountability in the state.

According to the report, there was a 38.8% increase in revenue from taxes and licensing fees in 2022 compared to 2021, primarily due to two key factors:

- Regaining gaming revenues after the most difficult years of the COVID-19 pandemic.

- The expansion of gambling in the state, which was enacted into law in June 2019, is particularly significant because it authorized sports betting in Illinois. Furthermore, it permitted the addition of six terrestrial casinos throughout the state, including a major site in Chicago, and increased the number of video gaming terminals.

The report said:

Tax revenues from gaming in Illinois, designated by the state, dropped by 11.7% to $1.240 billion in the 2020 fiscal year. Despite bouncing back with a 9.5% rise to $1.358 billion in the 2021 fiscal year, these revenues still fell short of the $1.404 billion generated pre-pandemic in the 2019 fiscal year.

In the fiscal year 2022, Illinois established new revenue records for:

- Lottery: $833 million

- Video gaming: $762 million

- Sports betting: $142 million

Illinois sports betting a new revenue source for the state

The report stated that Illinois sportsbooks reported adjusted gross receipts amounting to approximately $611 million in the second complete year of legalized sports betting in Illinois. Additional revenue was generated through licensing fees.

Sports betting in Illinois has introduced a new income stream for the state. With tax revenues of $57 million generated from its $380 million adjusted gross receipts total in FY 2021, the tax total from sports betting increased to around $92 million in FY 2022. This increase was due to a 15% tax on its AGR total of just over $610 million. Extra income is collected from licensing fees. Most of this tax income and fees are allocated to the Capital Projects Fund and the Rebuild Illinois Projects Fund.

Statistics on Illinois sports wagering

The statistics are recorded in millions of dollars and based on the fiscal year.

| Fiscal Year | Wagers | Handle | Payout | Adjusted Gross Revenue | Tax Revenue |

|---|---|---|---|---|---|

| 2020 | 192,007 | $9 | $8 | $0 | $0 |

| 2021 | 146,8883,248 | $5,106 | $4,727 | $380 | $57 |

| 2022 | 221,742,054 | $8,515 | $7,904 | $610 | $92 |

| TOTAL | 368,817,309 | $13,630 | $12,639 | $991 | $149 |

The decision to eliminate in-person sportsbook registration greatly contributed to the growth of IL sports betting.

“This has enabled new gamblers to join the sports betting arena, primarily as mobile users via sportsbook apps.”

Excluding the 15% rate, the revenue from sports betting licensing fees for the state was:

- $7.1 million in 2020

- In 2021, as the growth of sports betting spread across the State, there was a total of $61.8 million.

- $14.3 million in 2022.

The anticipated decrease from 2021 to 2022 occurred following the initial surge of new licenses in 2021.

“Nonetheless, the allocation of more licenses and the every 4-year renewal fees should yield a consistent income from fees in the upcoming years.”

In total, the state has amassed over $83 million from sports betting through licensing fees.

Record revenue despite lower average tax rates

Despite lower tax rates and a decrease in casino revenue, records were still made in terms of revenue. The primary reason for the surge in revenue is the robust growth in the previously mentioned sectors: lottery, video gaming, and sports betting, according to the report.

In the fiscal year 2022, the largest source of gaming tax revenues was lottery transfers, accounting for 44.2% of the total revenue. However, this proportion has been steadily decreasing from a recent peak of 67.8% in the fiscal year 2013. In contrast, video gaming revenue has significantly increased its share in the last decade, now contributing 40.4% of the total revenue. Casino transfers, which made up over 50% of gaming-related revenues a decade ago, have dropped to 7.4% in fiscal year 2022. Sports wagering, in only its second full year, has rapidly increased its share to 7.5%. Meanwhile, horse racing revenues continue to contribute a minimal 0.4%.

The growth in video gaming revenue can be attributed to the consistent rise in the number of machines. In 2019, the state permitted an increase in the terminal limit from 5 to 6 machines in regular establishments and from 5 to 10 terminals at eligible truck stops. Illinois now boasts over 43,000 machines. This has significantly contributed to a 36.1% surge in net terminal income from 2021 to 2022.

However, this has resulted in a decrease of 20.3% in casino revenue compared to last year.

“Nonetheless, when revenues are combined with video gaming totals, there’s been a 140.2% increase from $1.6 billion to $3.9 billion.”

What are the tax rates?

The average effective tax rate on all gaming declined from 27.3% in 2020 to 20.1% in 2022.

The Education Assistance Fund has seen a decrease in the transfer of revenues, with only $140 million transferred in FY 2022, compared to previous years. Despite anticipated growth in Adjusted Gross Revenue (AGR) in the coming years due to new casino developments, the overall increase in tax revenue from this gaming expansion is expected to be minimal. This is due to the cannibalization of existing gaming options and the negative impact of the altered tax structure on revenues.

The tax rate for sportsbooks in Illinois is 15%.

The tax rates for casinos vary on a graduated scale, based on whether the gambling occurred at a table game or an electronic gaming device. Please note that the Chicago casino will have different percentages. The tax rates are as listed below:

| Adjusted Gross Receipts | Previous Rate | New Rate on Table Games | New Rate on Electronic Gaming Devices |

|---|---|---|---|

| Up to $25 million | 15% | 15% | 15% |

| $25M to $50M | 22.5% | 20% | 22.5% |

| $50M to $75M | 27.5% | 20% | 27.5% |

| $75M to $100M | 32.5% | 20% | 32.5% |

| $100M to $150M | 37.5% | 20% | 37.5% |

| $150M to $200M | 45% | 20% | 45% |

| Over $200M | 50% | 20% | 50% |

The tax for video gaming is currently at 34% of the net terminal income. This is an increase from the previous rates of 30% before 2019 and 33% from 2019 to 2021, when the current rate was implemented.

The significant growth in the State share of tax revenues to the Capital Projects Fund is due to these rate increases and the substantial rise in net terminal income.

In 2022, the Illinois lottery reported a slight decrease in total sales, dropping to $3.396 billion, a 1.6% decrease from 2021. According to preliminary and unaudited data from the Lottery, operating costs, which include prizes for winners, retailer commissions and bonuses, and general and administrative expenses, amounted to $2.563 billion.

The state generated $833 million in revenue solely from the lottery.

Illinois ranks 12th in the US in lottery

By the end of Illinois’ fiscal year, not all national statistics were available. However, according to the data from the North American Association of State and Provincial Lotteries, Illinois had the 12th largest lottery in the U.S. in both FY 2021 and 2020 when considering total traditional lottery sales. These traditional sales include instant and draw games but do not cover electronic gaming machines and table games.

In 2021, the states with the highest lottery sales in the nation were:

- Florida has $9.1 billion, California has $8.4 billion, Texas has $8.1 billion, and New York has $7.7 billion.

In 2021, Illinois held the 21st position in per capita lottery sales with $272 per person, marking a 21% increase from the previous year. The states with the highest per capita sales were:

- Per person, Massachusetts costs $833.

- Georgia — $544

- Michigan — $502

In 2021, Illinois residents allocated 0.41% of their personal income to lottery tickets, an increase from 0.35% in 2020. For both years, Illinois held the 24th rank in this aspect.

Where the tax revenue goes

Here’s a quick overview of where all this money goes:

- The Lottery, after deducting the costs of prizes, agent commissions, and administration, contributes to the Common School Fund, the Capital Projects Fund, or other special cause funds. Since its establishment in 1975, the Lottery has amassed sales close to $80 billion and has funneled over $24 billion back to the State.

- Betting on Sports: The Capital Projects Fund and the Rebuild Illinois Projects Fund.

- 85% of video gaming proceeds go to the Capital Projects Fund, while 15% is allocated to local governments.

- Casinos: Education Assistance Fund.