FanDuel, DraftKings Dominate Illinois Sports Betting Market Share

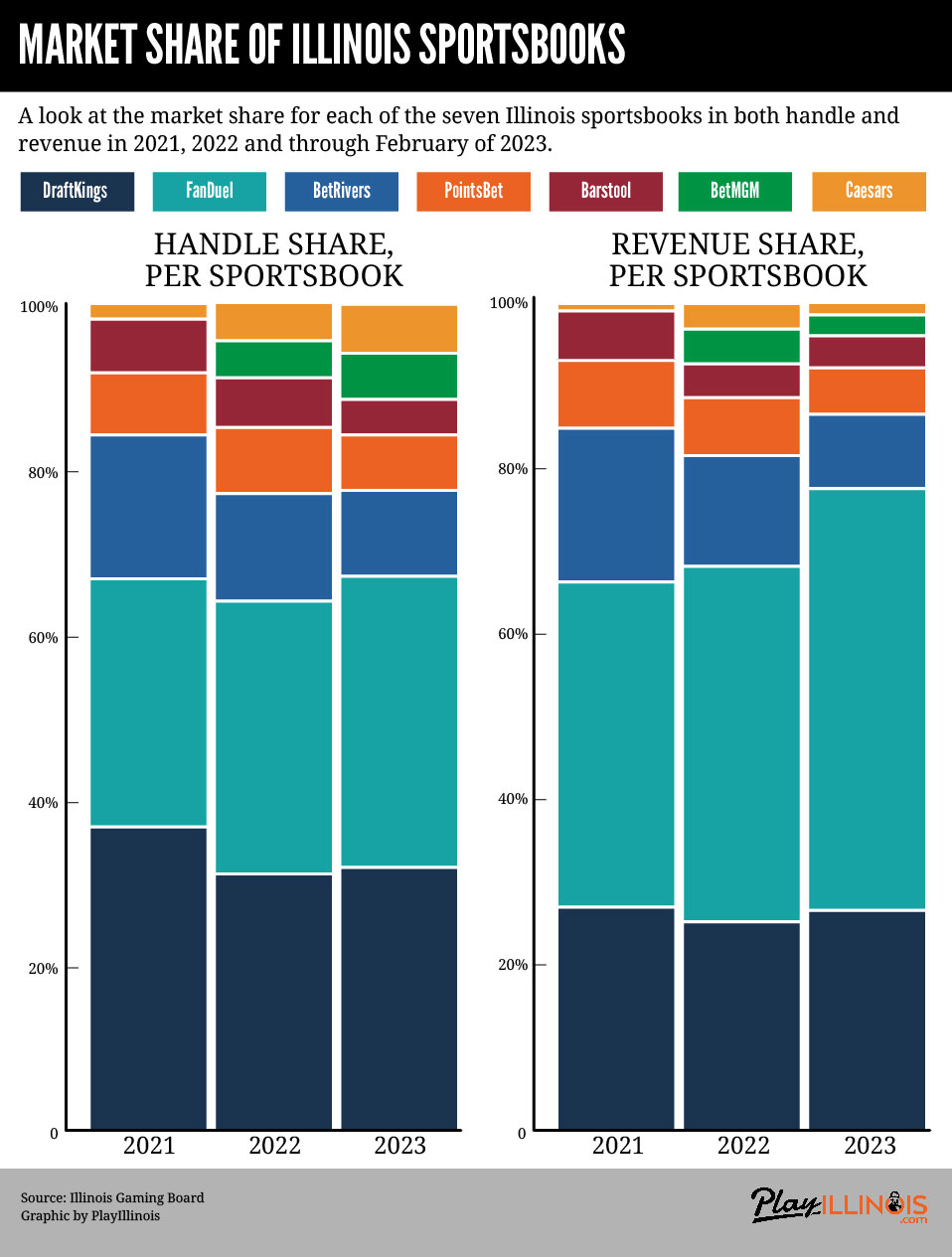

Which Illinois sportsbook is king? It depends on how you measure it. One thing’s for sure, DraftKings and FanDuel dominate in Illinois.

Play Illinois took a deep dive into the Illinois Gaming Board’s numbers and found that DK and FD have over 60% of the market combined.

That leaves the five other IL sports betting sites duking it out for the remaining 40%.

Lifetime, more than $20.4 billion has been bet through the seven legal Illinois sportsbook operators. The state crossed the $20 billion handle mark in February, the most recent numbers released by the IGB. Illinois is also one of the top sports betting jurisdictions in North America. It routinely ranks second or third.

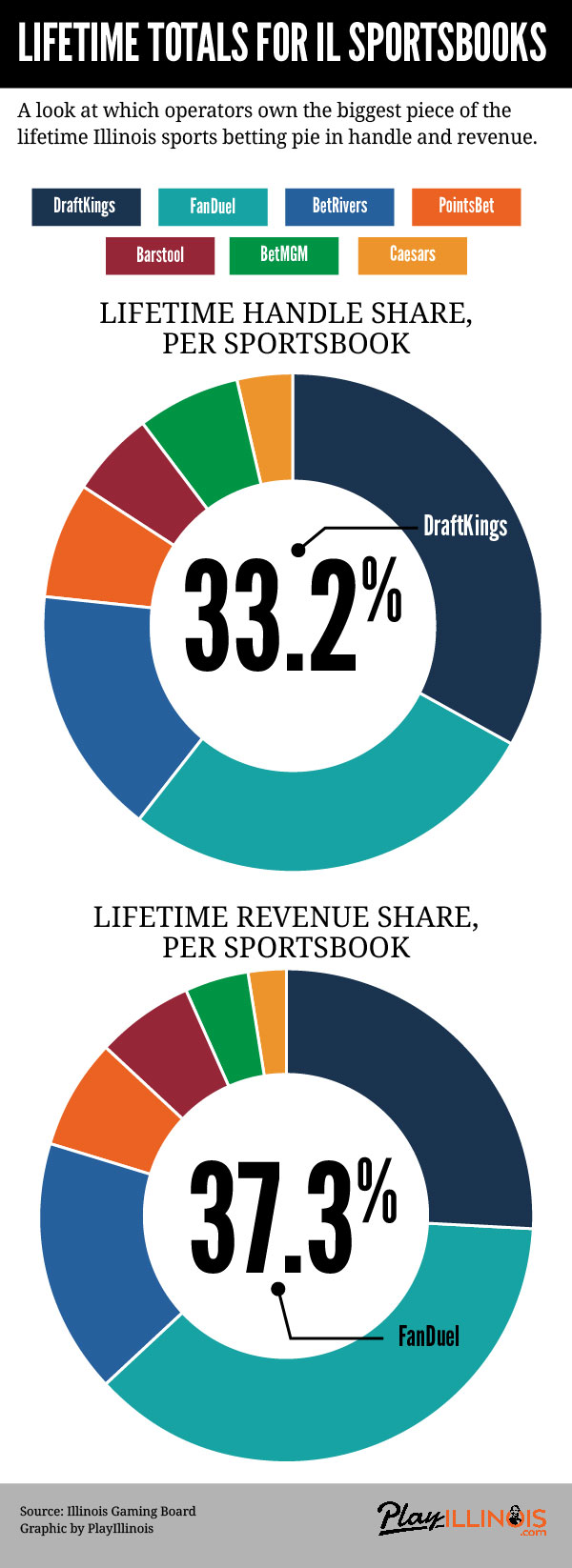

By handle, DraftKings is the king of the Illinois sports betting sites. More than $6.8 billion has been wagered through DraftKings Illinois. That amounts to a market share of 33.2%. FanDuel has 27.3% of the market thanks to wagering of nearly $5.6 billion.

In terms of lifetime revenue, the seven sportsbooks in Illinois have collected over $1.6 billion through February 2023. By revenue, FanDuel is the top book and DK is second. FanDuel Illinois has lifetime revenue of more than $600 million, for a 37.3% share of the market. DraftKings has a 26% share for its revenue of nearly $420 million.

A complete look at the market share

Lifetime market share by handle (through February 2023) ranks as follows:

- DraftKings — 33.2%

- FanDuel — 27.3%

- BetRivers — 16.1%

- PointsBet — 7.7%

- BetMGM — 6.6%

- Barstool — 5.5%

- Caesars — 3.5%

When it comes to revenue, the number one and two spots are reversed, with FanDuel taking the crown.

Lifetime market share by revenue (through February 2023):

- FanDuel — 37.3%

- DraftKings — 26%

- BetRivers — 16.6%

- PointsBet — 7.3%

- BetMGM — 6.3%

- Barstool — 4.3%

- Caesars — 2.3%

Where that leaves the other five Illinois sportsbook operators

So, we know that DraftKings and FanDuel have gobbled up a huge share of the Illinois sportsbook market. Where does that leave the other five Illinois sports betting sites?

BetRivers, which is based in Illinois, is a solid third in its home state. Lifetime, BetRivers is responsible for over $3.3 billion in handle and has produced revenue of nearly $268 million. That means, just over 16% of the total sports betting handle has come through BetRivers. The company has taken in about 16.6% of the total revenue.

Add FanDuel, DraftKings and BetRivers together and the three make up more than 75% of the Illinois regulated sports betting sector.

That doesn’t bode as well for PointsBet, BetMGM, Barstool and Caesars.

Bottom four Illinois sports betting operators divide up remaining 25%

Of the remaining four Illinois sportsbooks, PointsBet is a solid fourth with about 7.7% of the handle (in their case more than $1.5 billion lifetime). PointsBet Illinois has produced lifetime revenue in Illinois of more than $117 million. That’s about 7.3% of the total Illinois sports betting revenue of more than $1.6 billion.

That leaves BetMGM, Barstool and Caesars with between 13 and 16% of the Illinois market, combined.

It terms of both handle and revenue, the remaining three rank as follows:

- BetMGM

- Barstool

- Caesars

In terms of revenue, BetMGM Illinois is, by far, the leader of those three with over $101 million. Barstool has revenue of nearly $70 million. Caesars is a distant seventh in the state with just shy of $40 million. That amounts to a revenue share of 6.3%, 4.3% and 2.3%, respectively.

Lifetime revenue (through February 2023):

- FanDuel — $601,754,326

- DraftKings — $419,159,877

- BetRivers — $267,827,419

- PointsBet — $117,232,821

- BetMGM — $101,205,956

- Barstool — $69,987,485

- Caesars — $36,926,648

It’s a little closer when you look at handle, at least between BetMGM and Barstool. BetMGM has lifetime handle of more than $1.3 billion in Illinois. Barstool has taken in over $1.1 billion in bets in the Prairie State. Caesars has handled more than $721 million. That amounts to a handle share of 6.6%, 5.5% and 3.5%, respectively.

Lifetime handle (through February 2023):

- DraftKings — $6,800,930,712

- FanDuel — $5,583,131,054

- BetRivers — $3,303,421,020

- PointsBet — $1,565,765,310

- BetMGM — $1,360,091,685

- Barstool — $1,130,026,574

- Caesars — $721,219,850

Market dominance makes it tough for new sportsbooks in Illinois

Sometime this year, Circa will become the eighth legal sports betting operator in Illinois.

With the top three operators devouring more than 75% of the market, it won’t be easy for Circa. But, at least Circa has a bit of a unique selling proposition as a sportsbook that caters to big bettors and doesn’t limit gamblers like most of the rest.

In November, Play Illinois handicapped sportsbooks coming next to the state.

There are at least 14 open slots for an Illinois online sportsbook to enter the market and possibly a few more than that:

- Six via a tether with an existing licensed retail casino

- Five via a tether with new casino applicants

- Three via online-only sportsbook licenses

- Maybe as many as four connected to pro sports facilities

Price of entry is certainly an issue. Though, some legislation is floating around Springfield to try to lower the cost.

Currently, the minimum price for a sportsbook license is $5 million. The price to come into the market while tethered to an original retail casino license holder was 5% of adjusted gross receipts — or a percentage of handle in the case of the two horse racing tracks. The actual price ranged from about $2.3 million to $10 million.

For any new casino or track, it’s still based on a percentage, but the minimum cost is $5 million. A license to operate a sportsbook at a professional sports facility costs $10 million.

There are three online-only sportsbook licenses available that do not require a tether to a retail casino. But, they do cost $20 million for a license.